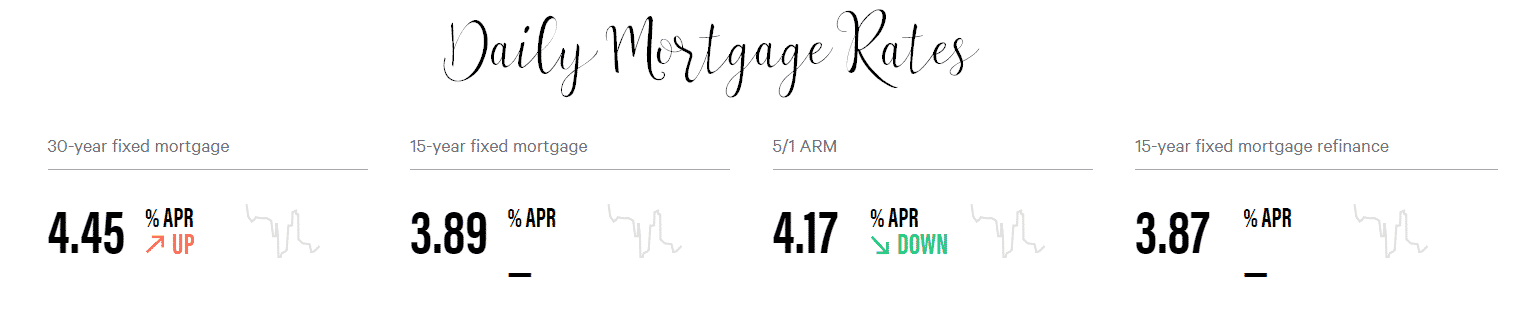

by Elsa Soto | Jul 2, 2018 | Blog, Buyers, Local Events, Mortgages, News, Real Estate News

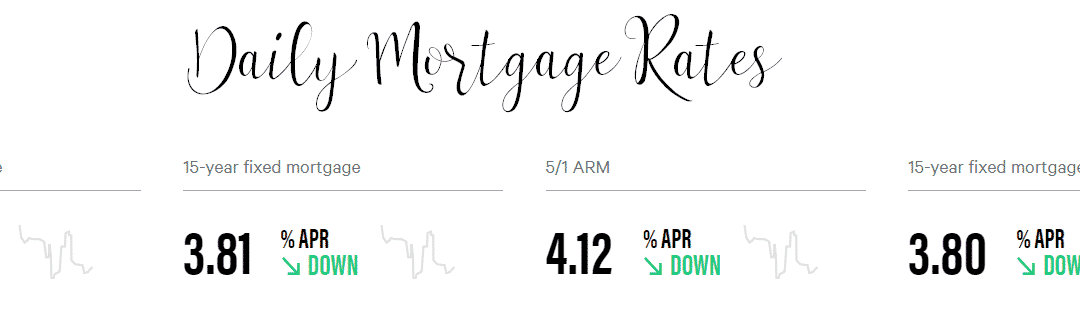

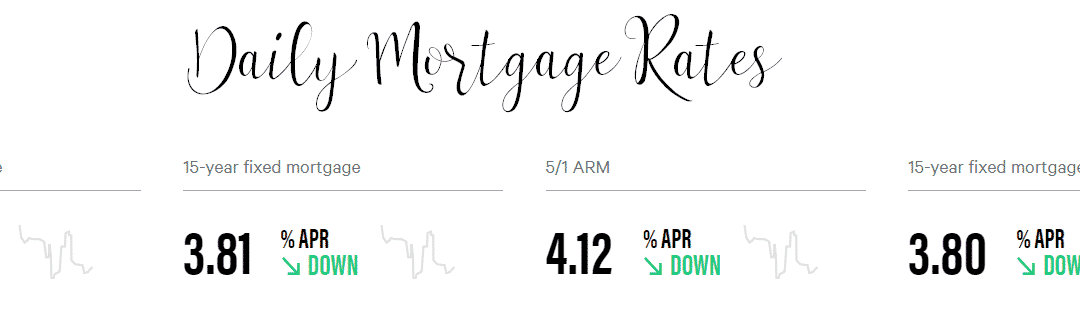

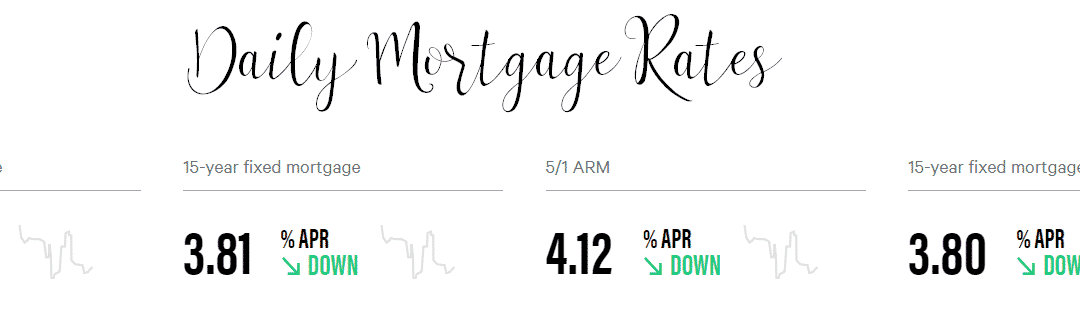

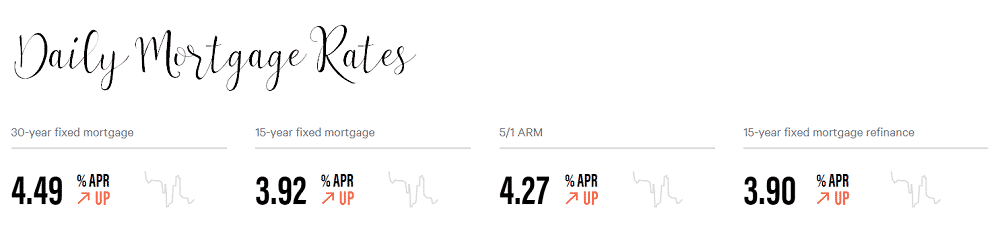

Daily Mortgage Rate Welcome to this weeks snapshot of Orlando’s Mortgage Rate Monday! Take a look at the rates that have lowered just a bit since the last snap shot. Now has never been a better time to invest your hard earned money into something that will...

by Elsa Soto | Jun 25, 2018 | Blog, Buyers, Mortgages, Real Estate News

Welcome to this weeks snapshot of Orlando’s Mortgage Rate Monday! Take a look at the rates that have lowered just a bit since the last snap shot. Now has never been a better time to invest your hard earned money into something that will continue to reward you,...

by Elsa Soto | Jun 14, 2018 | Blog, Investment Property in Florida, Mortgages, News, Property for Sale

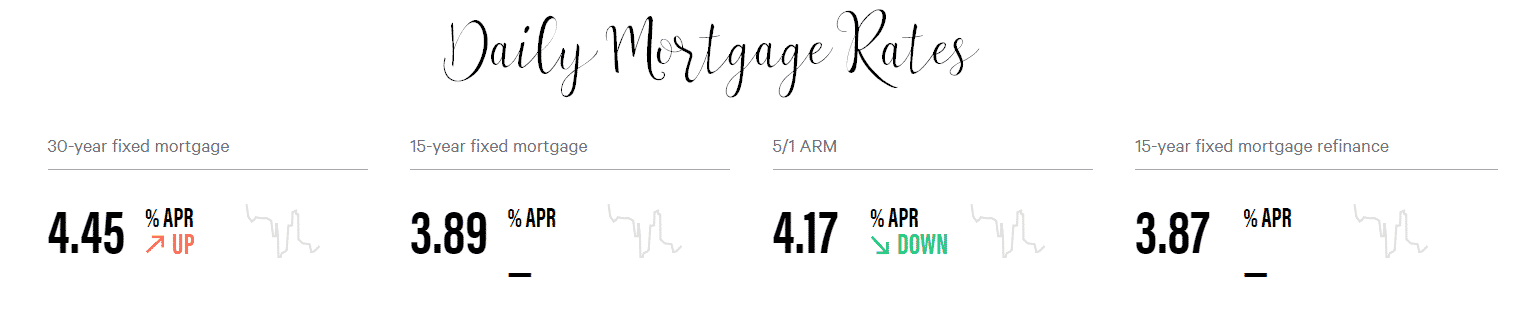

Orlando Mortgage Rates Keep Steady Mortgage rates are determined by the lender and can be either fixed, staying the same for the term of the mortgage, or variable, fluctuating with a benchmark interest rate. Mortgage rates vary for borrowers based on their credit...

by Elsa Soto | Jun 7, 2018 | Homes, Villas and Condos, Investment Property in Florida, Mortgages, News, Real Estate News

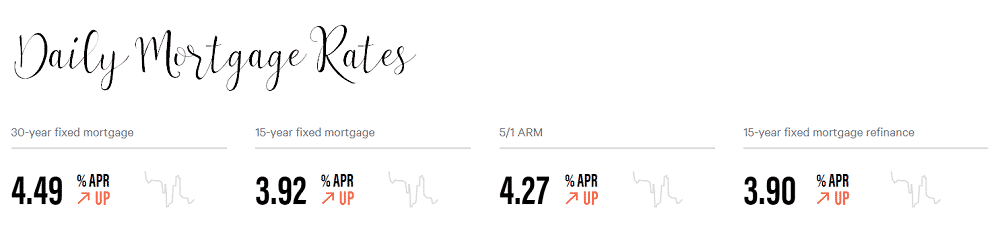

Mortgage rates moved lower again this week, only the second time this year that rates have fallen in back-to-back weeks. According to the latest data released Thursday by Freddie Mac, the 30-year fixed-rate average slipped to 4.54 percent with an average 0.5 point....

by Elsa Soto | May 10, 2018 | Buyers, Homes, Villas and Condos, Investment Property in Florida, Mortgages, News, Property for Sale in Orlando, Real Estate News, Uncategorized

WASHINGTON (AP) – May 10, 2018 – The key long-term U.S. mortgage rate held steady this week, providing a lure for potential homebuyers as the spring buying season goes forward. Mortgage buyer Freddie Mac said Thursday the average rate on 30-year, fixed-rate mortgages...