by Elsa Soto | Jan 22, 2021 | Blog, Mortgages, New Construction, News, Press Releases, Real Estate News

WASHINGTON (January 22, 2021) – December 2020 home sales report rose reaching their highest level since 2006, according to the National Association of Realtors®. Activity in the major regions was mixed on a month-over-month basis, but each of the four areas recorded...

by Elsa Soto | Jan 15, 2021 | Blog, Homeowners, Real Estate Components, Real Estate News, Sellers

Things are coming to a boil in the market for U.S. homes, and it may be the right time to sell.In October, prices for houses across the U.S. registered the fifth-largest monthly gain since 1996 and the strongest in 15 years. The heat is coming from a mix of factors,...

by Elsa Soto | Dec 19, 2020 | Blog, Buyers, Homeowners, Homes, Villas and Condos, Investment Property in Florida, News, Real Estate News, Renters, Sellers

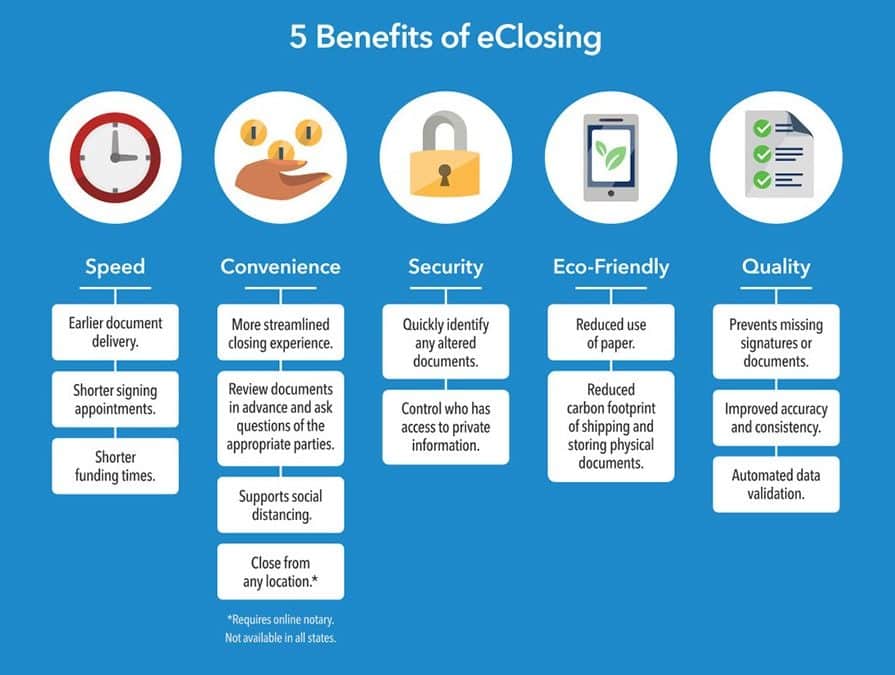

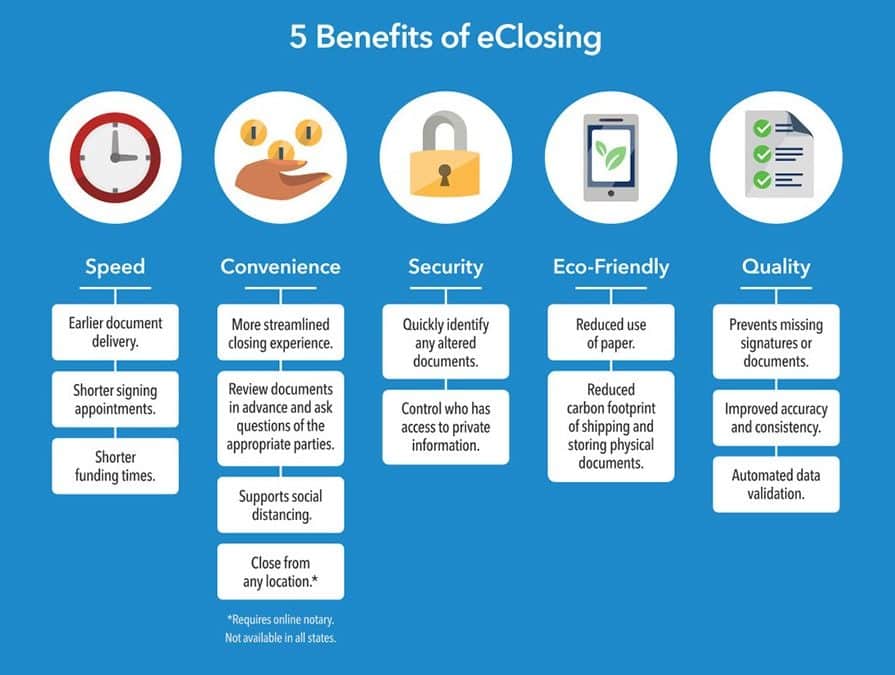

Online Closings are here! Learn about digital closings and how to get your practice ready. Real estate closings will change over the next 2-3 years and move in the direction of less paper and more technology. Lenders are recognizing the efficiency and cost savings...

by Elsa Soto | Dec 18, 2020 | Blog, Buyers, Homeowners, Renters, Sellers, Things to Do in Orlando

272 CALABAY PARC BOULEVARD, DAVENPORT, FLJust SoldProperty VideoDescriptionPhotosMaps & LocalPrintFollow This HomeDavenport Homes For SaleClermont Homes For SaleFree Home ValuesSearch All Homes For SalePresented By:Bardell Real EstateBardell Real...

by Elsa Soto | Dec 14, 2020 | Blog, Buyers, Homeowners, Homes, Villas and Condos, Real Estate News, Renters, Sellers

1307 CASTERTON CIRCLE, DAVENPORT, FLJust SoldProperty VideoDescriptionPhotosMaps & LocalPrintFollow This HomeDavenport Homes For SaleClermont Homes For SaleFree Home ValuesSearch All Homes For SalePresented By:Bardell Real EstateBardell Real...