by Elsa Soto | Jun 9, 2020 | Blog, Buyers, Press Releases, Real Estate News, Renters, Sellers

From the Boom years through the great recession of 2009, Steve Silcock Broker / Own er at Bardell Real Estate thought he had experi enced most chal-lenges a business owner can face …until the first global pandemic !! “For the last 30 years Bardell has helped it’s...

by Elsa Soto | Jun 1, 2020 | Blog, Buyers, News, Real Estate Components, Real Estate News, Renters, Sellers

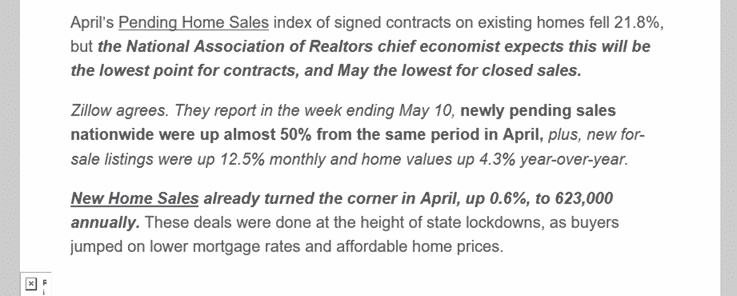

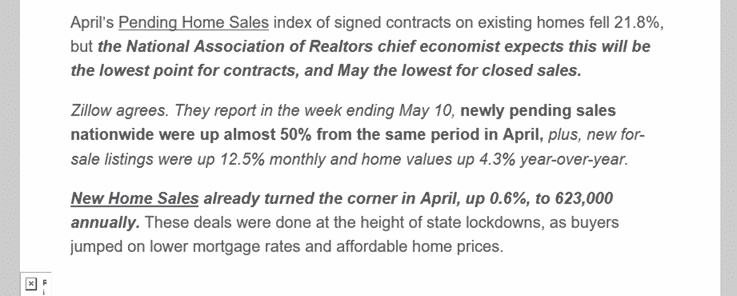

Stay-at-home orders to prevent the spread of coronavirus put a major dent in the number of contracts that were signed in April, The index of pending home sales dropped 21.8% in April compared to March as the coronavirus pandemic kept prospective home-buyers out of the...

by Elsa Soto | May 27, 2020 | Blog, Buyers, Real Estate News, Renters, Theme Parks and Attractions

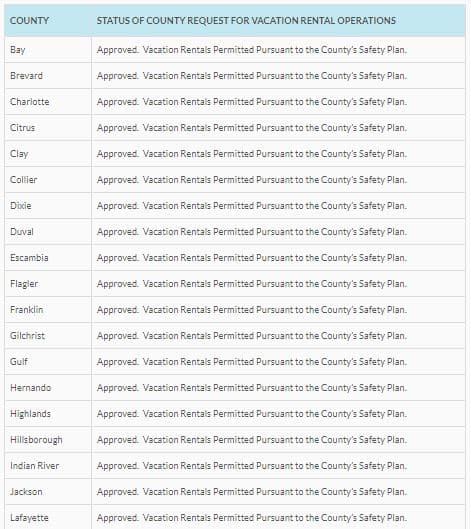

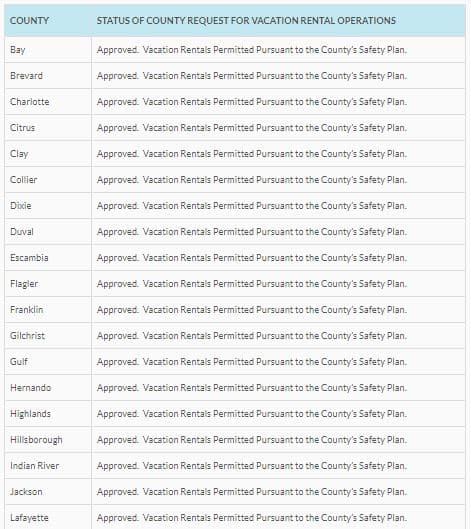

Part of Florida Gov. Ron DeSantis’ response to the coronavirus pandemic was to authorize the Florida Department of Business and Professional Regulation (DBPR) to approve the reopening of vacation rentals based on plans submitted by counties. During the pandemic and...

by Elsa Soto | May 21, 2020 | Blog, Local Events, News, Press Releases, Real Estate News, Things to Do in Orlando

Home buyer IncentivesBe sure you’re sending the right message to buyers when you throw in a homebuyer incentive to encourage them to purchase your home.When you’re selling your home, the idea of adding a sweetener to the transaction — whether it’s a decorating...

by Elsa Soto | May 14, 2020 | Blog, Press Releases, Real Estate News

ORLANDO, Fla. – In the first quarter of 2020, Florida’s housing market reported higher median prices and more closed sales compared to a year ago, though the coronavirus pandemic’s impact on the state’s economy and real estate markets began to emerge in mid-March,...

by Elsa Soto | May 11, 2020 | Blog, Buyers, Real Estate News

How long does it take to improve your credit score? Having good credit helps you prove your creditworthiness to potential lenders. If you’re hoping to buy a home, having a good credit score is key, since it helps you qualify for a mortgage. So if your credit...