by Elsa Soto | Feb 28, 2019 | Blog, Buyers, Homeowners, Homes, Villas and Condos, Mortgages, News, Real Estate News

Mortgage Rates Stay Subdued as Housing Reform Issues Grab the SpotlightMortgage Rates for home loans were little changed near long-time lows, providing a little breathing room for would-be buyers even as policymakers are increasingly taking an interest in housing...

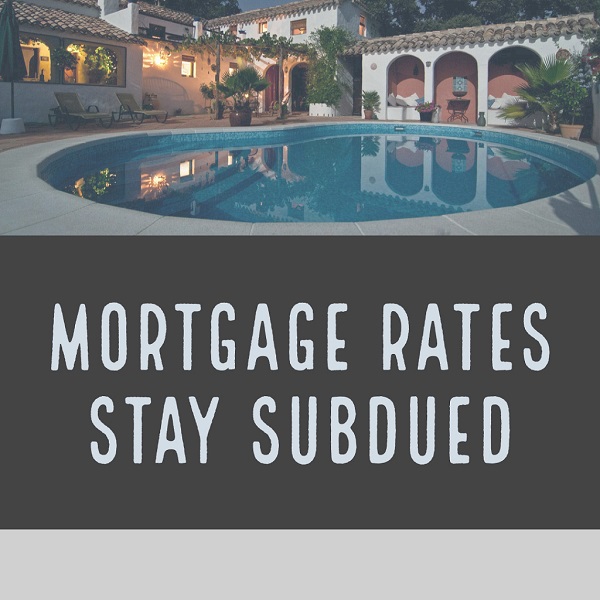

by Elsa Soto | Jan 21, 2019 | Blog, Homeowners, Mortgages, News, Real Estate News

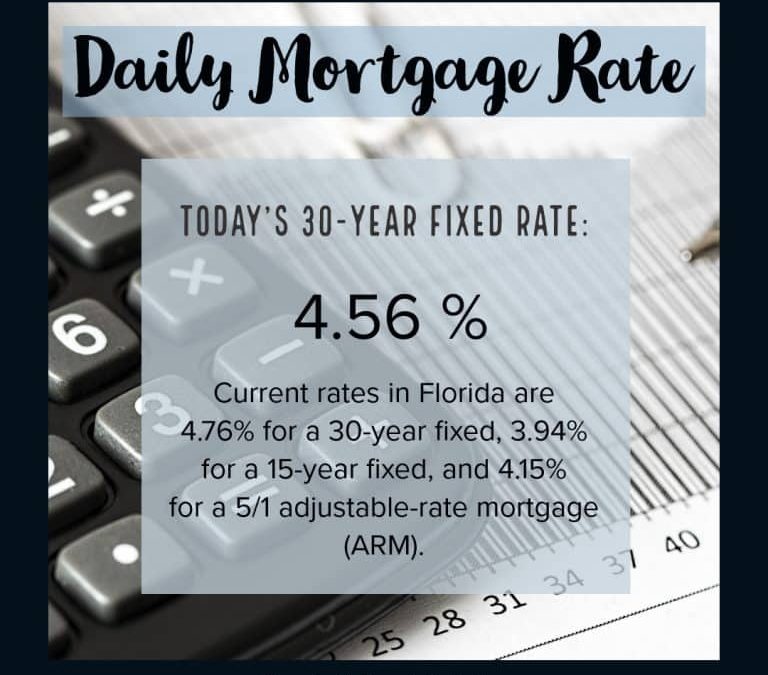

Central Florida’s Daily Mortgage Rates Welcome to this weeks snapshot of Central Florida Daily Mortgage Rates! Does your New Year’s Resolution include spending time to invest your hard earned money into something that will continue to reward you,...

by Elsa Soto | Dec 31, 2018 | Blog, Buyers, Homeowners, Mortgages, News, Real Estate Components

Central Florida’s Daily Mortgage Rates Welcome to this weeks snapshot of Central Florida Daily Mortgage Rates! Does your New Year’s Resolution include spending time to invest your hard earned money into something that will continue to reward you,...

by Elsa Soto | Nov 26, 2018 | Blog, Buyers, Homeowners, Mortgages, News, Property for Sale in Orlando, Real Estate News

Central Florida’s Daily Mortgage Rates Welcome to this weeks snapshot of Central Florida Daily Mortgage Rates! Now has never been a better time to invest your hard earned money into something that will continue to reward you, especially with ownership!...

by Elsa Soto | Nov 21, 2018 | Blog, Buyers, Homes, Villas and Condos, Mortgages, New Construction, News, Property for Sale, Property for Sale in Orlando

Central Florida’s Daily Mortgage Rates Welcome to this weeks snapshot of Central Florida Daily Mortgage Rates! Now has never been a better time to invest your hard earned money into something that will continue to reward you, especially with ownership! Source:...