Get to know more about The Four Corners area

Get to know more about The Four Corners area

Why move to the Four corners area

Lake County

Location and Geography: Understand the town’s location, geography, and surroundings. Consider factors like proximity to major cities, access to natural amenities (e.g., mountains, beaches), and the local climate.

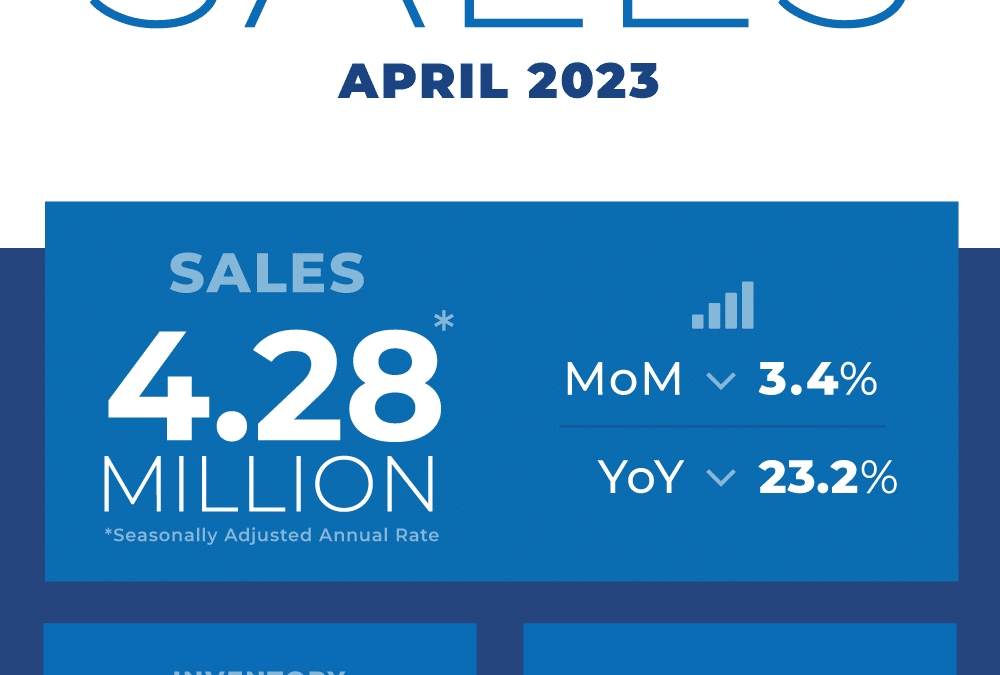

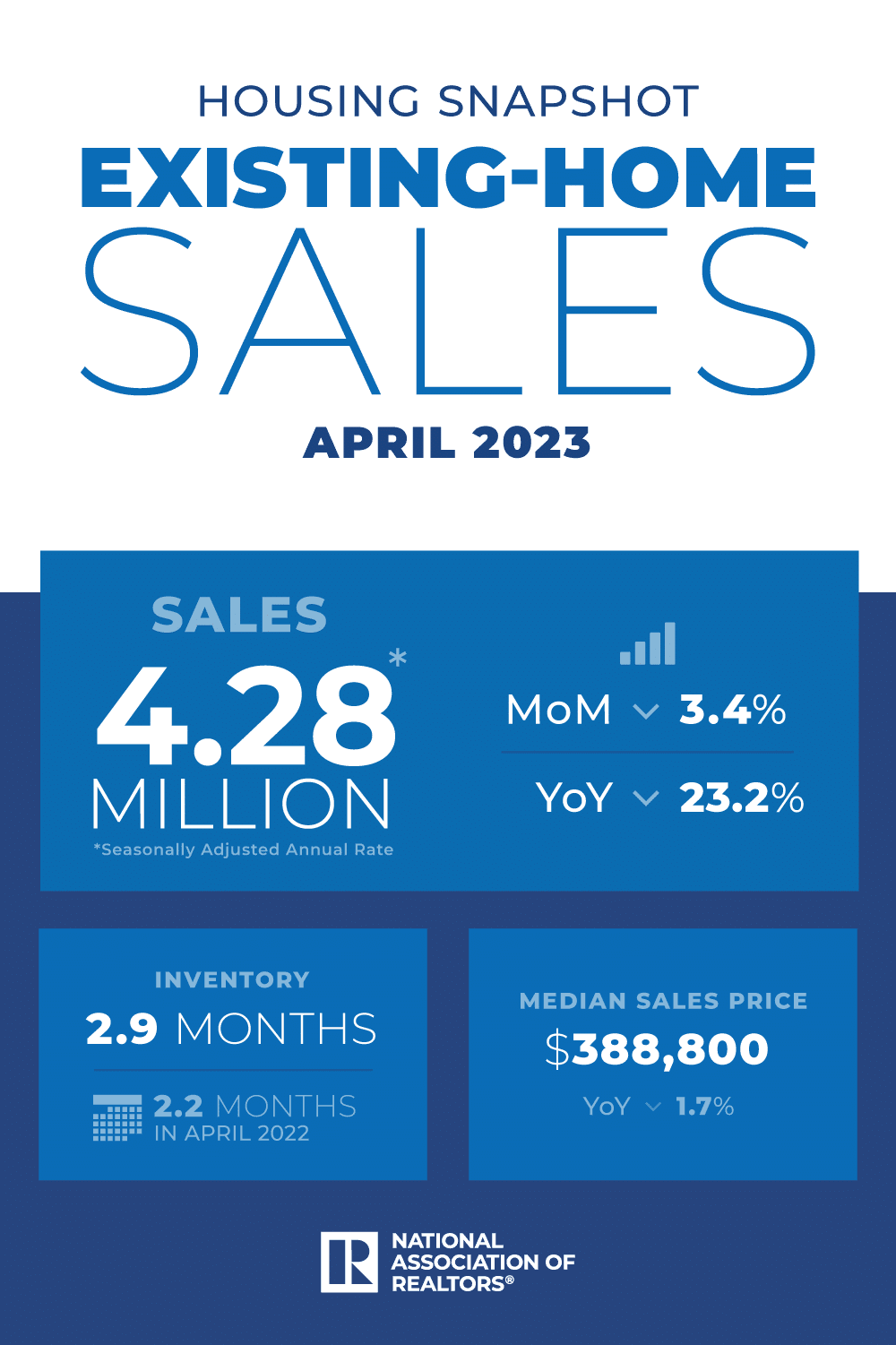

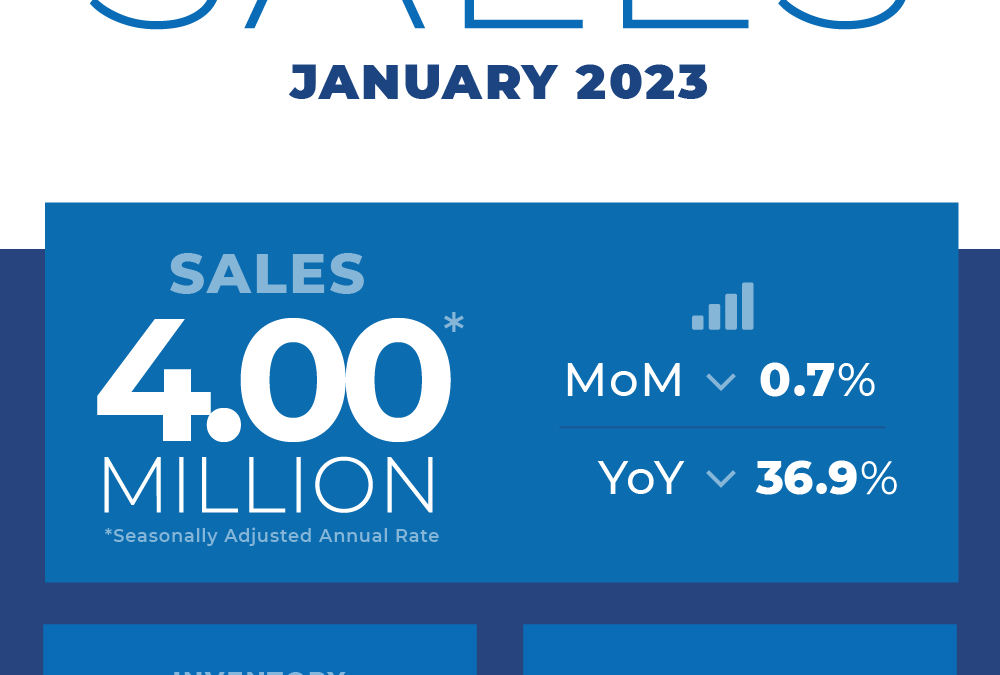

Housing Market: Investigate the town’s housing market, including rental and purchase prices. Determine the type of housing that suits your needs and budget. Check out properties for sell in the area Resale Properties New construction

Commute and Transportation: Calculate your daily commute time and transportation options. Determine if public transportation, walking, or biking is feasible, and assess the town’s traffic patterns

Community and Lifestyle: Explore the town’s culture, lifestyle, and community. Consider your interests, hobbies, and how well they align with what the town offers. Check out our Blog for future events

Orange County

Location and Geography: The county seat is Orlando, which is also the largest city in Orange County. The county is known for its vibrant tourism industry, with popular attractions such as Walt Disney World, Universal Orlando Resort, and SeaWorld Orlando. Orange County is also home to a diverse population and offers a range of cultural, recreational, and educational opportunities.

Housing Market: It is a desirable location due to its proximity to popular attractions and a range of amenities. These factors have contributed to a steady demand for housing in the area.

Commute and Transportation: Orange County has an extensive network of roads and highways, including Interstate 4 (I-4) and the Florida Turnpike, which provide convenient access to different parts of the county and beyond. Lynx is the public transportation system serving Orange County. It operates a network of buses that cover a wide range of routes throughout the county, including express routes to downtown Orlando. Lynx also offers a paratransit service for individuals with disabilities.

Community and Lifestyle: Orange County offers a vibrant community and a diverse lifestyle. The county is known for its warm climate, beautiful beaches, and numerous recreational opportunities such as a variety of outdoor activities, including water sports, golfing, hiking, and biking. Residents can enjoy exploring the county’s many parks, nature preserves, and lakes. Orange County is famous for its world-class theme parks, including Walt Disney World, Universal Orlando Resort, and SeaWorld Orlando. These attractions draw visitors from around the globe and provide residents with endless entertainment options.

Osceola County

Location and Geography: Osceola County is characterized by a mix of urban and rural areas. It is part of the greater Orlando metropolitan area and is known for its proximity to popular tourist destinations. The county is bordered by Lake Tohopekaliga to the west and the Kissimmee River to the east. It also encompasses parts of the Kissimmee Chain of Lakes, which offers recreational opportunities for boating and fishing. Osceola County has a diverse landscape, including wetlands, forests, and agricultural areas. The county’s location in Central Florida provides a subtropical climate, with hot and humid summers and mild winters.

Housing Market: Osceola county offers a range of housing options, including single-family homes, townhouses, and condominiums. The prices and availability of properties can vary depending on factors such as location, size, and amenities. Osceola County has experienced significant growth in recent years, driven by factors such as its proximity to popular tourist destinations like Walt Disney World and Universal Orlando Resort, as well as its strong job market. This growth has led to increased demand for housing in the area.

Commute and Transporation: Major highways that pass through or near Osceola County include Interstate 4 (I-4), which runs east-west and connects the county to Orlando and Tampa. State Road 417 (Central Florida GreeneWay) is a toll road that provides a convenient route for traveling north-south through the county. State Road 192 (Irlo Bronson Memorial Highway) is another major road that runs east-west and is known for its commercial areas and access to popular tourist destinations.

Community and Lifestyle: Osceola County offers a range of recreational activities and amenities. It is known for its natural beauty, with numerous lakes, parks, and outdoor spaces for residents to enjoy. The county also has a strong focus on sports and recreation, with facilities for golf, tennis, soccer, and more. Additionally, the county has a strong sense of community with various events, festivals, and cultural celebrations throughout the year. The local school system strives to provide quality education, and there are also higher education institutions in the area.

Polk County

Location and Geography: It encompasses a mix of urban areas, suburban communities, and rural regions. The county is known for its numerous lakes, with over 550 lakes dotting its landscape. The largest lake in Polk County is Lake Kissimmee. The county’s terrain features a combination of flatlands, rolling hills, and wetlands. Polk County is also home to various natural attractions, including state parks, wildlife preserves, and recreational areas. It offers opportunities for outdoor activities such as boating, fishing, hiking, and wildlife observation.

Housing Market: Polk County has had a diverse and competitive housing market. It is located in central Florida and offers a mix of urban and suburban areas. The county is known for its affordability compared to some neighboring counties, which can make it an attractive option for homebuyers.Factors such as population growth, economic conditions, and local amenities can influence the housing market in Polk County.

Commute and Transportation: Polk County is well-connected by a network of major highways, including Interstate 4 (I-4) that runs east-west through the county. Other important roadways include US Highway 27, US Highway 98, and State Road 60. Polk County offers public transportation services through the Citrus Connection. This includes fixed-route bus services that operate throughout the county, connecting various cities and communities.

Community and Lifestyle: The county is home to several cities and towns, including Lakeland, Winter Haven, and Haines City, each with its own unique charm and amenities. The county also hosts various cultural events, festivals, and community gatherings throughout the year. Education is a priority in Polk County, with a number of public and private schools serving the community. The county is also home to several higher education institutions, including Polk State College.

Ready to make a Move?

Bardell Real Estate are the experts in helping you with your selling, buying or renting needs near Orlando, Florida. Make your Disney area experience a forever memorable one. Call us now to speak to a real estate agent.

[formlift id=”36911″]