How long does it take to improve your credit score? Having good credit helps you prove your creditworthiness to potential lenders. If you’re hoping to buy a home, having a good credit score is key, since it helps you qualify for a mortgage. So if your credit score is low, indicating bad credit, knowing how long it takes to raise it to the home-buying range can help you plan.

How long does it take to improve your credit score? Having good credit helps you prove your creditworthiness to potential lenders. If you’re hoping to buy a home, having a good credit score is key, since it helps you qualify for a mortgage. So if your credit score is low, indicating bad credit, knowing how long it takes to raise it to the home-buying range can help you plan.

Credit repair companies sometimes promise almost instant results, saying that they will do the hard work. However, there’s no secret to raising your score, and it can’t happen overnight. It is possible to raise your credit score within one to two months. It may take even longer, depending on what’s dragging down your score and how you handle it. Here’s step-by-step advice for do-it-yourself credit repair that works.

How long does it take to raise a credit score?

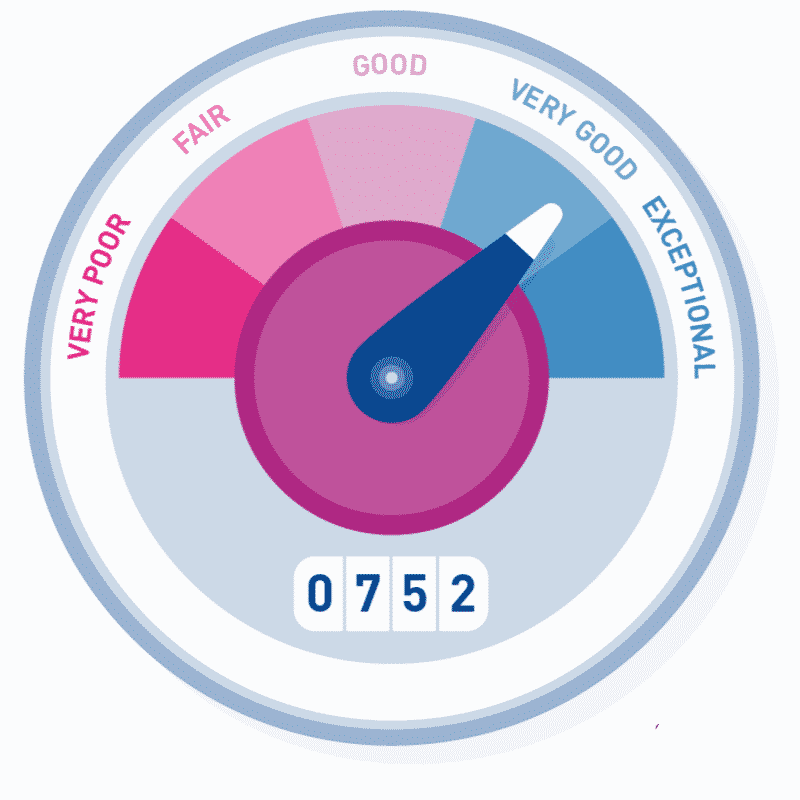

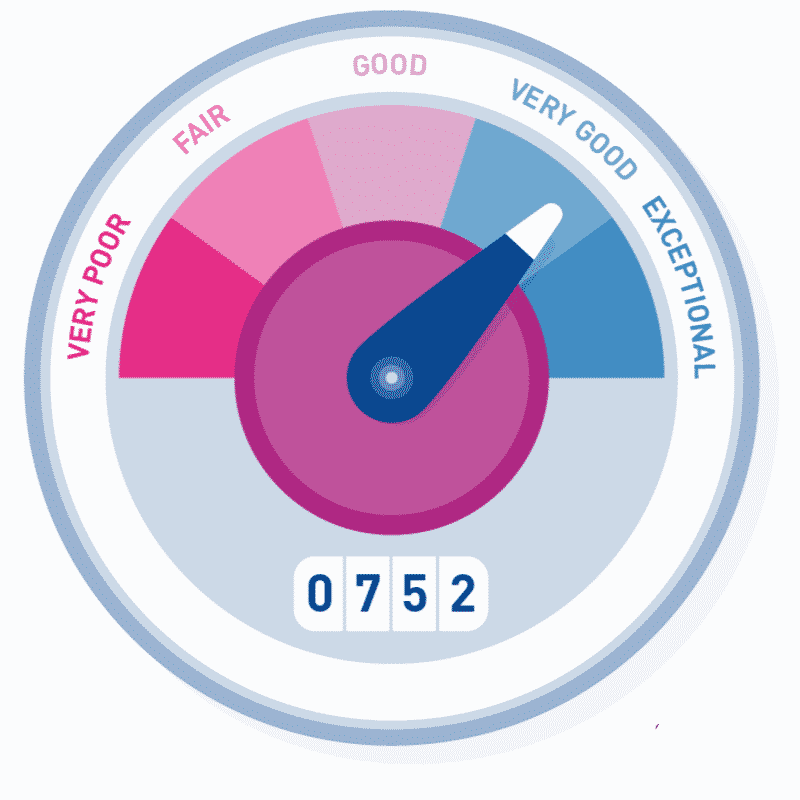

First off, what’s considered a good score versus a poor one? Here are some general parameters:

- Perfect credit score: 850

- Excellent score: 760-849

- Good credit score: 700 to 759

- Fair score: 650 to 699

- Low score: 649 and below

While the score required varies by area and type of loan, lenders will generally look for a score of 660 or higher before they will grant a mortgage. (Here’s more on the minimum credit score you need for a home loan. If you’re hoping to boost your credit score fast, here are some actions you can take.

Correct errors on your credit report

Correcting errors on your credit report is a relatively quick way to improve your credit score. If it’s a simple identity error—like a credit card that’s not yours showing up—you can get that corrected within one to two months. If it’s an error on one of your accounts, though, it could take longer, because you need to involve your creditor as well as the credit bureau.

The entire process typically takes 30 to 90 days. If there’s a lot of back-and-forth between you, the credit bureau, and your creditor, it could take longer.

The first step to correcting errors is to get a copy of your free credit reports from TransUnion, Equifax, and Experian (the three major credit bureaus). You can do this at no cost once a year at annualcreditreport.com.

Next, review your credit report for errors. If it’s an error on one of your accounts, you must refute that error with the bureau by providing documentation arguing otherwise. For example, if you paid a credit card on time and the card issuer is reporting a late payment, find a bank statement showing that you paid on time.

Credit bureaus typically have 30 days to investigate the error. If they agree that it’s an error, they will remove the item. The credit bureau may also ask for additional information or ask you to discuss the information with the creditor involved. If that’s the case, stay on top of communications with your creditor so you can get things resolved as quickly as possible.

Build a credit history if needed

A low credit score doesn’t always mean you have bad credit. It can just mean you have thin credit. In other words, you haven’t demonstrated enough creditworthiness to potential lenders, at least that they can see on your credit report.

If that’s the case, you may need to open a credit account, such as a credit card, and make payments on it regularly. Try to get a card with no annual fee, if possible. Don’t overspend, or use this as an excuse to take out loans you don’t need.

You could get a secured credit card, for example, and pay for gas and other regular expenses with it. To avoid paying high interest charges or building credit card debt, track your balance throughout the month and pay the balance off every month.

Deal with delinquent accounts

If you have bad credit, bringing delinquent accounts current and settling accounts that are in collections can also boost your score fairly quickly. Once the creditor or collection agency reports your account update, you should see a positive bump in your score.

Keep in mind, though, that your late payment history will remain on your credit report for seven years. If you have bad accounts that have been on your report for six years or more, you may not want to worry about settling them or bringing them up to date. This can re-age the account, and if you fall behind again, it will stay on your credit report for another seven years.

“Make sure you don’t re-age these accounts, because they’re going to drop off soon,” says Nathan Danus, CDMP and director of housing and community development at DebtHelper in West Palm Beach, FL. Negative information typically “falls off” your credit report after seven years, so if you’re close, it’s best to just wait it out.

Lower your credit utilization ratio

Your credit utilization ratio refers to how much you owe compared with the amount of available credit you have. For example, if you have a $10,000 credit limit across all your credit cards and you have balances totaling $9,000, you’ve utilized 90% of your credit. This drags down your score.

“What these consumers often need to do is pay down the balances on their existing credit accounts, which can be a challenge if they’ve allowed the balances to creep up over time,” says Martin H. Lynch, compliance manager and director of education at Cambridge Credit Counseling of Agawam, MA.

“The ratio of what’s owed to the amount of credit available represents 30% of the consumer’s score, so rapid improvement is possible if there’s a large amount of money available to pay down balances.”

Linda L. Jacob, a financial counselor at Consumer Credit of Des Moines, IA, recommends paying down balances to below one-third of your credit line. Any payments you make will be reflected on your credit report as soon as your creditors report your payment to the credit bureaus.

Scores are updated on an ongoing basis, and creditors typically report once per month, so if you make a payment that lowers your credit utilization, that should be reflected on your score within two months.

If you’re regularly using your credit card but you want to keep your utilization low so you can apply for a mortgage, you may want to pay down your credit card balance on a weekly or biweekly basis. This ensures that your balance is as low as possible whenever your creditor reports your payment history to the credit bureaus.

You can also decrease your card utilization by getting more credit, but this approach can backfire. Consumers sometimes assume that by getting new credit, their score will improve. If you have a $3,000 balance on a card with a $4,000 credit limit and you’re approved for a new credit card with a $1,000 limit, you now have $5,000 in total credit lines. Instead of using 75% of your available credit, you’re now using 60%. That’s better, right? Not necessarily.

“Just applying for credit lowers your credit score, and that effect lasts for months,” warns Mike Sullivan, personal finance consultant at Take Charge America in Phoenix. “For the first few months after you apply for credit, your credit score may actually go down.”

You can try getting around this by asking a credit limit increase on a card you already have, instead of opening new credit. Be sure to ask whether they do a “soft” credit pull rather than a “hard” credit pull for a credit limit increase, though, since hard credit inquiries are the ones that affect your credit history.

A creditor may be willing to give you a credit line increase with a “soft” pull, which will not hurt your score. Soft inquiries are for background purposes only.

For example, a credit card company may do a soft pull to see if you’re eligible for certain credit card offers, or an employer may do a soft pull before offering you a job.

Soft pulls can be done without your permission and do not affect your score. Hard pulls require your permission, and are done when lenders or credit card companies are assessing whether to grant you a loan or line of credit.

How to raise your credit score for the long haul

Short-term damage control consists of correcting errors, settling your delinquent accounts, and optimizing your credit utilization to make your credit report look better. Contrary to what some credit repair places promise, you can’t delete genuine negative information from your credit history.

The only other things that will improve your long-term score are time and building up a perfect or nearly perfect payment history, starting now.

For example, if you tend to forget to make payments on credit card debt, you can set up automatic payments. You can set up payments to cover the entire amount, or a minimum amount every month. You can always pay the remaining balance when you get the statement.

You should also check your credit report on a regular basis, so you can fix any errors that occur; for example through identity theft. You’ll also see how your efforts are paying off.

You generally don’t need to pay for a credit report. You can get a free credit report once a year. You may also be able to check your credit report or even see your FICO score for free through your credit union, card issuer, or other financial institution.

And here’s some good news for people with bad credit: Generally, people with the lowest scores will see the biggest gains the fastest.

“It’s a lot like dieting,” says Sullivan. For instance, if your score is 550, “you could probably get it up 30 points in a matter of a couple months, if you’re really dedicated and really careful,” he explains.

On the other hand: “If your credit score is already a 750 and you’re trying to get it to 780, that can take double or more the time.” Still, it’s worth doing whatever you can to improve your credit history and make sure you qualify for the best interest rate possible.