by Elsa Soto | Oct 30, 2021 | Blog, Buyers, Homeowners, Mortgages, News, Real Estate News, Renters, Sellers

Market in a Minute-October Welcome to this months Market in a minute. Florida Realtors has released its resale housing market statistics for September, and they continue to show a pace of home sales activity well above pre-pandemic levels. Closed sales of existing...

by Elsa Soto | Aug 27, 2021 | Buyers, Mortgages, New Construction, News, Real Estate News, Renters, Sellers

August Market in Minutes Welcome to this months Market in a minute. Resale activity during July 2021 is showing multiple signs that the housing market is continuing on a steady path towards normality. Closed sales of single-family homes were down very slightly on a...

by Elsa Soto | Jul 29, 2021 | Blog, Mortgages, Real Estate News

June Market in a Minute Welcome to this months Market in a minute. We all know the housing market is booming and setting records. Median home prices in the Orlando area reached a new high in June 2021: $315,000. That is a 5% increase from the previous month and a 19%...

by Elsa Soto | Apr 23, 2021 | Blog, Mortgages, News, Real Estate Components, Real Estate News

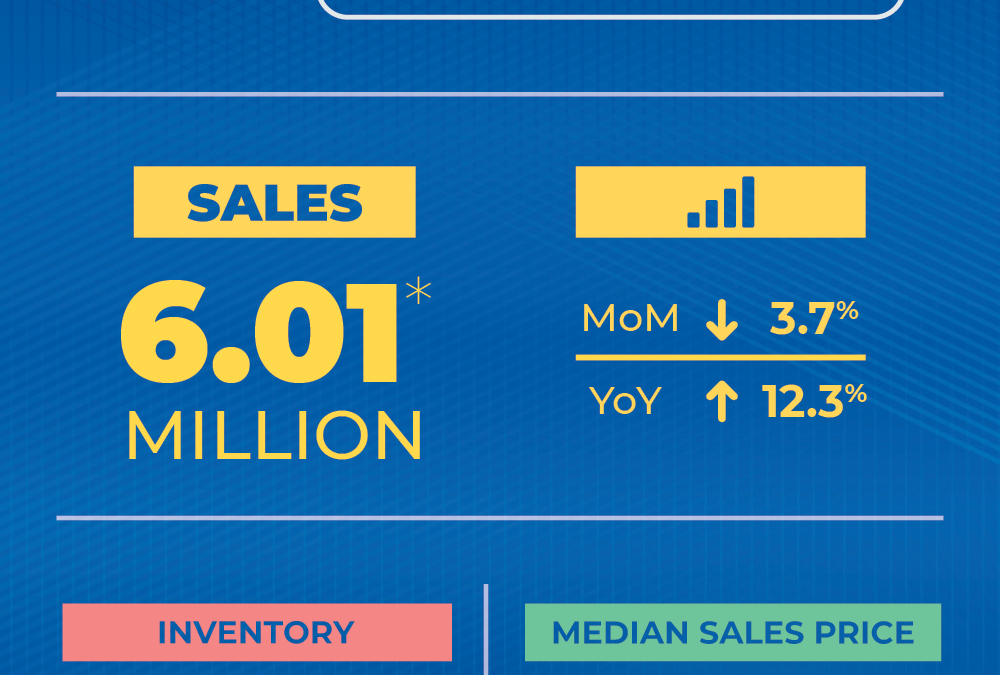

Housing Market Report-March WASHINGTON (April 22, 2021) – Existing-home sales fell in March, marking two consecutive months of declines, according to the National Association of Realtors®. The month of March saw record-high home prices and gains. While each of the...

by Elsa Soto | Jan 22, 2021 | Blog, Mortgages, New Construction, News, Press Releases, Real Estate News

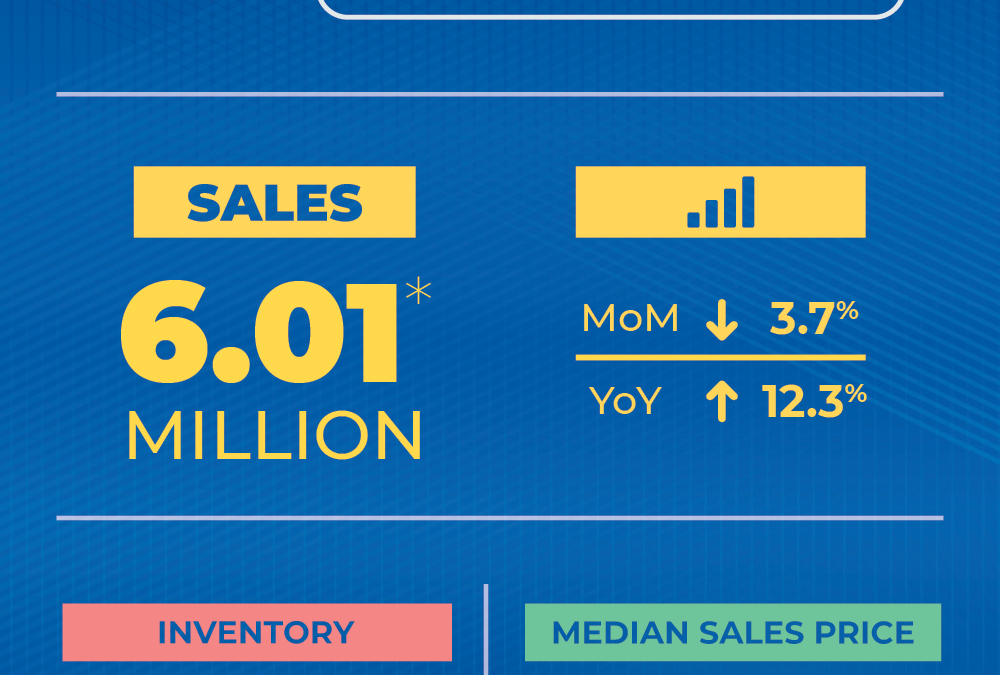

WASHINGTON (January 22, 2021) – December 2020 home sales report rose reaching their highest level since 2006, according to the National Association of Realtors®. Activity in the major regions was mixed on a month-over-month basis, but each of the four areas recorded...

by Elsa Soto | Nov 29, 2020 | Blog, Homeowners, Mortgages, Real Estate Components, Real Estate News

WASHINGTON (November 19, 2020) – October Home Sales Report shows and upward trend marking five consecutive months of month-over-month gains, according to the National Association of Realtors®. All four major regions reported both month-over-month and year-over-year...