by Elsa Soto | Jun 27, 2024 | Blog, Homeowners, Long Term Rental, News, Property Management, Real Estate Components, Real Estate News, Renters, Sellers

When to List Your Long-Term Rental with RE/MAX Heritage for the Best Results Located in the vibrant Four Corners area near Orlando, REMAX Heritage understands that advice on the best times to buy or sell property is readily available. But what if your goal isn’t...

by Elsa Soto | Jun 13, 2024 | Blog, Buyers, Homeowners, News, Renters, Sellers

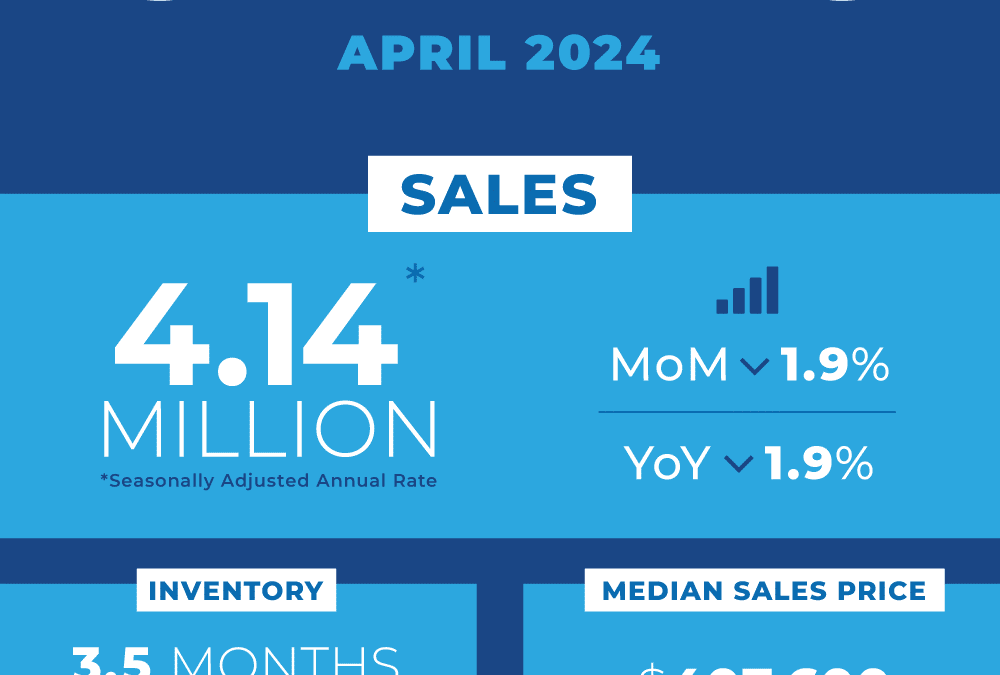

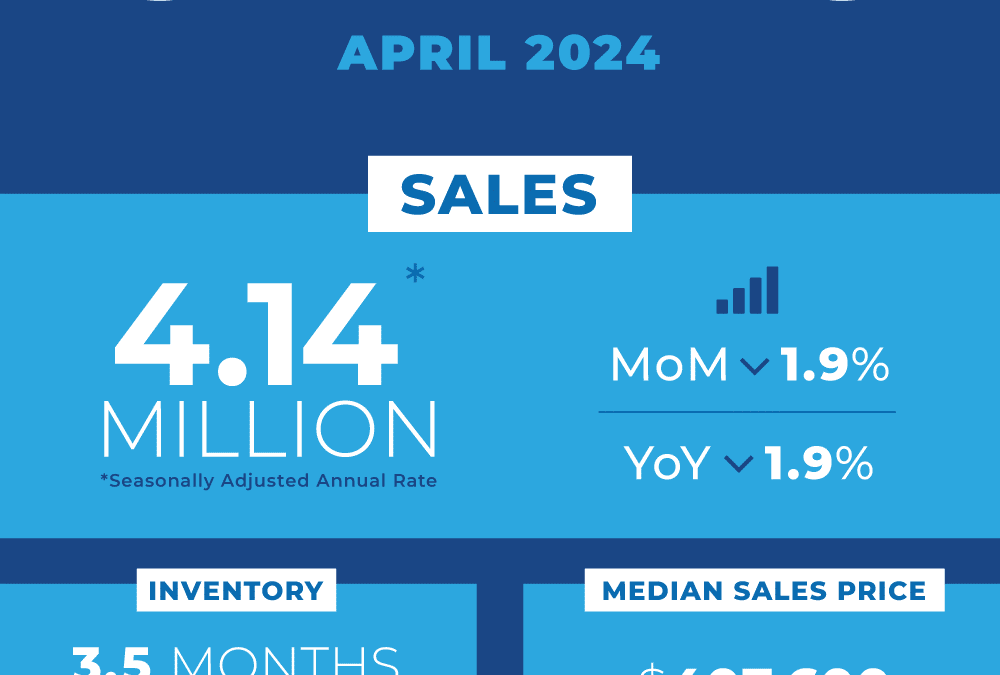

Real Estate Sales Report April 2024 In April, existing-home sales saw a decline nationwide, as reported by the National Association of REALTORS®. All major regions in the United States experienced decreases in sales compared to the previous month, with year-over-year...

by Elsa Soto | May 12, 2024 | Blog, Buyers, News, Renters, Sellers

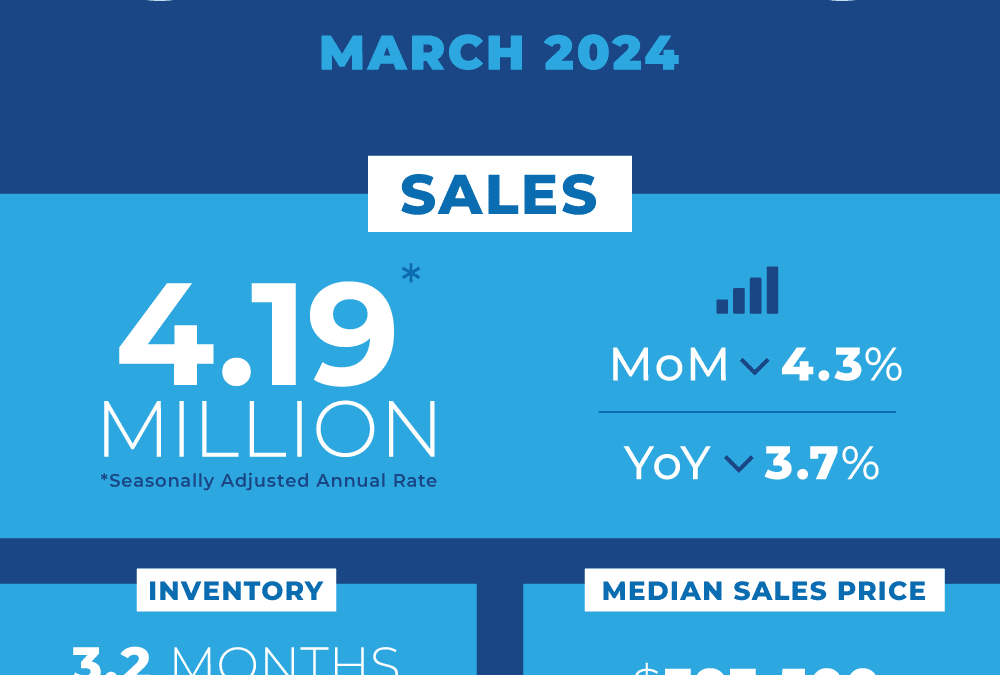

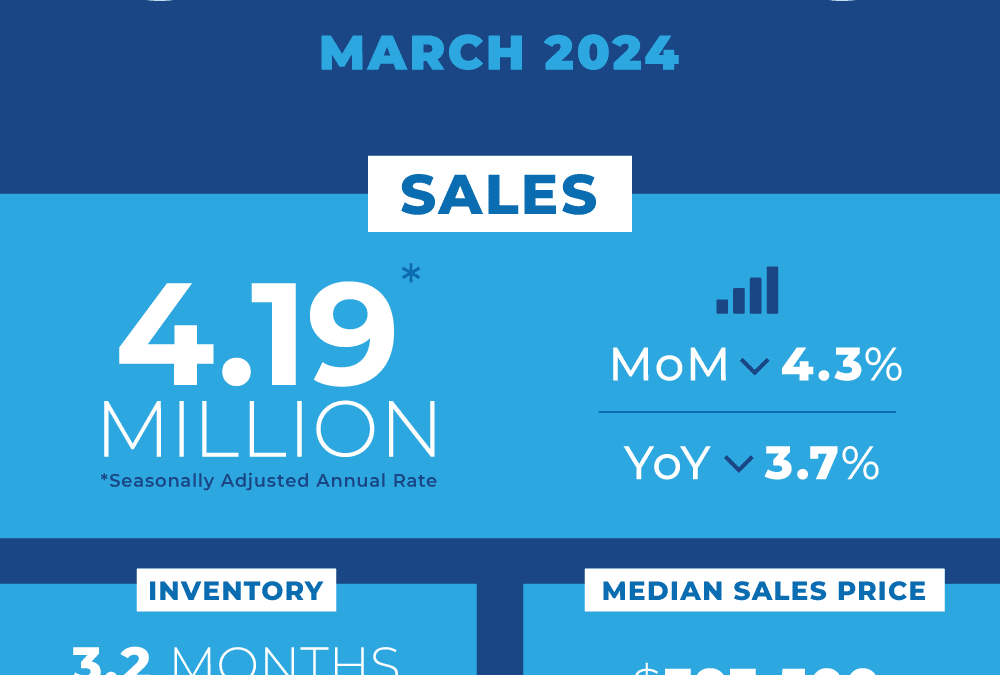

March Real Sales Report 2024 March Real Sales Report 2024 WASHINGTON (April 18, 2024) – The National Association of REALTORS® reported a decline in existing-home sales in March, noting decreases in the Midwest, South, and West, while sales increased in the...

by Elsa Soto | Apr 24, 2024 | Blog, Buyers, Real Estate Components, Renters

Why Having a Real Estate Agent is Essential for Your Home Purchase Journey Why Having a Real Estate Agent is Essential for Your Home Purchase Journey Considering buying a home in the Orlando Area? It’s a significant journey, but you don’t have to navigate...

by Elsa Soto | Apr 17, 2024 | Blog, Buyers, Homeowners, Homes, Villas and Condos, Investment Property in Florida, Long Term Rental, Mortgages, New Listing, News, Property for Sale, Real Estate News, Renters

JUST LISTED: 17717 WOODCREST WAY, CLERMONT 17717 Woodcrest Way, Clermont, FL Just Listed Description Photos Marketing Your Home Real Estate Reports for Home Owners, Sellers & Buyers! Maps & Local Schools Print $ CLICK FOR CURRENT PRICE 4 BEDROOMS 2.5...

by Elsa Soto | Apr 15, 2024 | Blog, Buyers, Homeowners, Homes, Villas and Condos, Investment Property in Florida, Long Term Rental, New Listing, News, Property for Sale, Renters, Retirement / 55+

JUST LISTED: 306 DOUGLAS PARK AVE, DAVENPORT Blog Post 8 306 Douglas Park Ave, Davenport, FL Click here to Get Directions Photos Maps & Local Schools Print $ CLICK FOR CURRENT PRICE 2 BEDROOMS 2 BATHROOMS 7375 sqft Lot Welcome to this charming home in Polo Park,...